rsu tax rate us

RSU tax rate canada vs US. RSUs are treated as supplemental income.

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

I got option from my company to start in Canada or in the US and my choice will affect how my RSUs are taxed.

. Generally there is no tax upon the sale of shares if the shareholder together with their fiscal partner has an interest less than 5 percent in the nominal subscribed share capital determined per class of shares. How does the tax rates in canada compare against the US. An RSU is a grant valued in terms of company stock but company stock is not issued at the time of the grant.

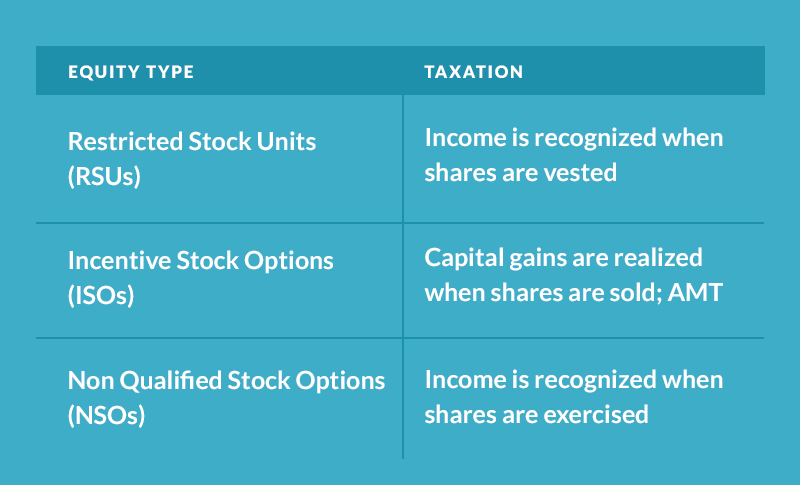

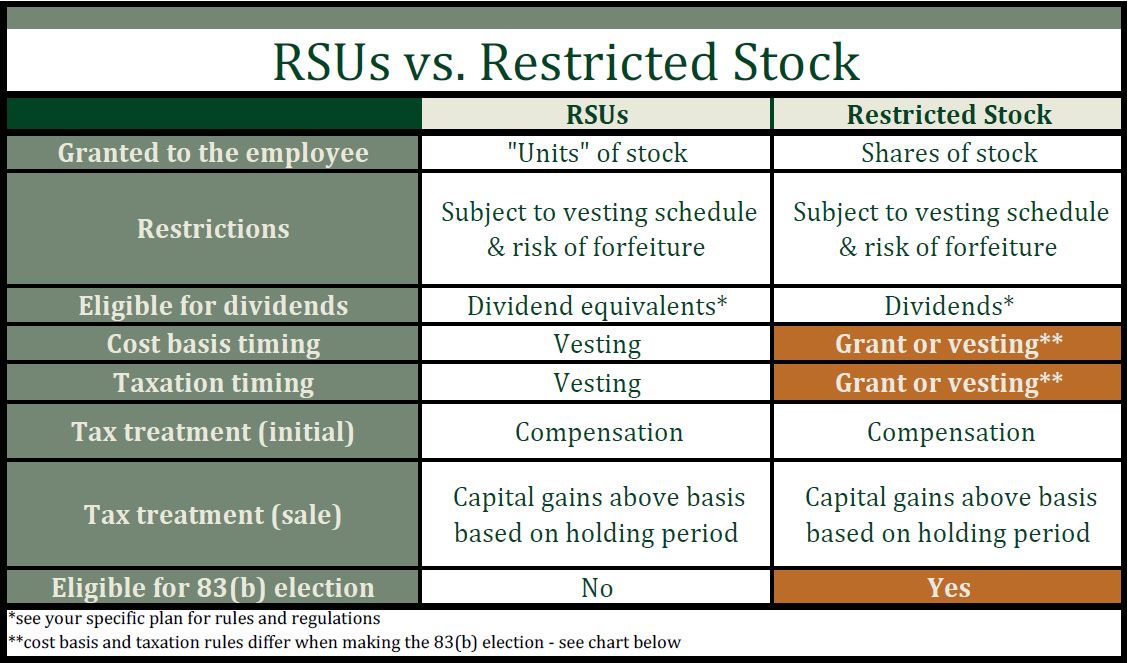

These are a kind of employee share option scheme and are most commonly being offered by multinational tech companies but are also offered by some banks and other smaller companies albeit sometimes under a different name. The beauty of RSUs is in the simplicity of the way they get taxed. Those plans generally have tax consequences at the date of exercise or sale whereas restricted stock usually becomes taxable upon the completion of the vesting schedule.

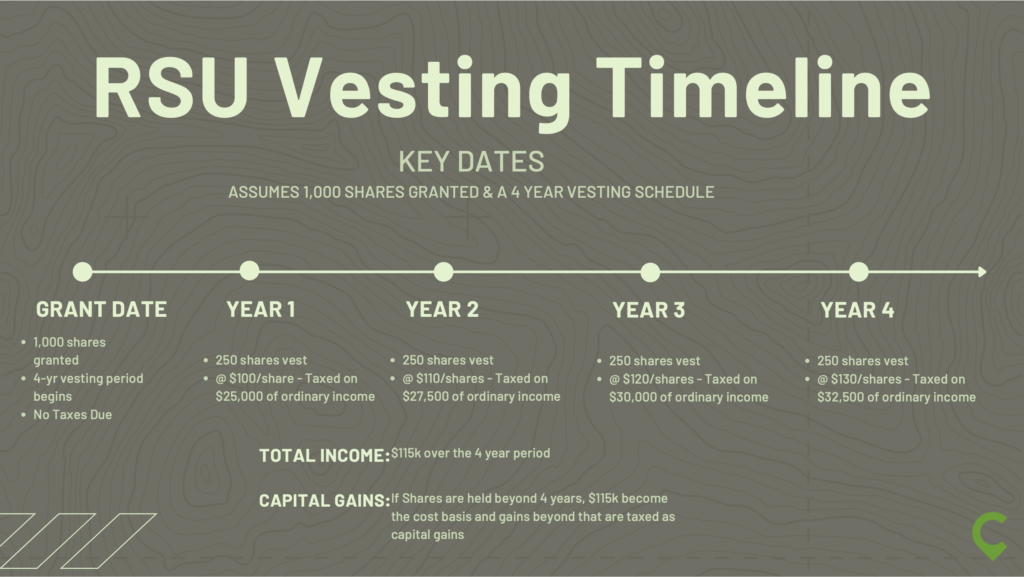

When you become vested in your stock its fair market value gets taxed at the same rate as your ordinary income. RSUs are taxed as normal income -- theres no separate rate for them. If you leave the vested stock in the market then normal capital gains taxes come into play.

22 for federal taxes 37 if total income is more than 1million Social Security and Medicare and Some amount for state income taxes if you live in a state that has an income tax. Many companies withhold federal income taxes on RSUs at a flat rate of 22 37 for amount over 1 million. On this page is a Restricted Stock Unit Projection calculator or RSU calculator.

RSUs are taxed at the ordinary income tax rate when they are issued to an employee after they vest and you own them. In other words if the stock increase in value after youve paid ordinary income tax. When the RSU vest with the employee he need to include it in his salary income as perquisite and pay tax on same.

Rsu tax rate us Sunday March 6 2022 Edit Tax treatment of RSUs in India The RSU perquisite is taxable based on the period of stay during the vesting period and resident status at the time of the grant of option. 613-751-6674 Chantal Baril Tel. RSU Tax Rate.

Posted by 2 hours ago. Many employers though make it far less convenient for the employee by withholding on supplemental income like RSUs and bonuses at a flat rate which includes. Vote level 1 3 min.

Canadian Tax Legal Alert CRA issues new views on RSU taxation in Canada April 21 2021 Contacts. At the time of vesting. After the recipient of a unit satisfies the vesting requirement the company distributes shares or the cash equivalent of the number of.

Restricted Stock Units better known as RSUs are an increasingly popular form of incentivisation offered to employees. Enter details of your most recent RSU grant your companys vesting schedule and some assumptions about your tax rate and your employers future returns. 514-393-5554 The Canada Revenue Agency CRA has issued new commentary 1 with respect to taxation of restricted stock units RSUs.

RSUs are taxed upon the delivery of shares which is generally upon vesting as income from employment at the progressive tax rate up to 495 percent. 514-393-6507 Amélie Desrochers Tel. What is the tax rate for an RSU.

Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock purchase plans ESPPs. Long-term are capital items like RSUs that are held for more than one year after they were grantedobtained. The companies many a times sell certain portion of such shares after vesting to pay the tax on such vesting.

On the other hand the rate for short term gains is the same as that for earned income which is 37 for high-income taxpayers. The exact tax rate will depend on your specific tax bracket as determined by your income. RSUs can trigger capital gains tax but only if the stock holder chooses to not sell the stock and it increases in value before the stock holder sells it in the future.

From there the RSU projection tool will model the total economic value of your grant over the years. Here is the information you need to know prior to jumping in. Hope you had a chance to glance over at the official Restricted Stock Unit RSU Strategy Guide.

Unlike the much more complicated ESPP they get taxed the same way as your income. For people working in California the total tax withholding on your RSUs are actually around 40. Now that you know the basics of how RSUs work you can now confidently use the RSU Tax Calculator Below.

Restricted Stock Units RSUs Tax Calculator. Thus the RSU above attracts tax two times. The 22 doesnt include state income Social Security and Medicare tax withholding.

RSUs are taxed as W-2 income subject to federal and employment tax Social Security and Medicare and any state and local tax. 1 At the time of vesting and 2 At the time of sale. Ago counts the same as all other income.

This rate is 238 20 plus the 38 tax on net investment income for high-earning taxpayers. A restricted stock unit RSU is a form of equity compensation used in stock compensation programs. Unless specific facts and.

Vote More posts from the personalfinance community 35k Posted by 4 days ago Auto. RSU tax rate canada vs US.

Why Rsus Can Make Tax Season Painful Schmidt

Navigating Your Equity Based Compensation Restricted Stock Restricted Stock Units Verum Partners

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

A Tech Employee S Guide To Rsus Cordant Wealth Partners

Rsu Tax Rate Is Exactly The Same As Your Paycheck

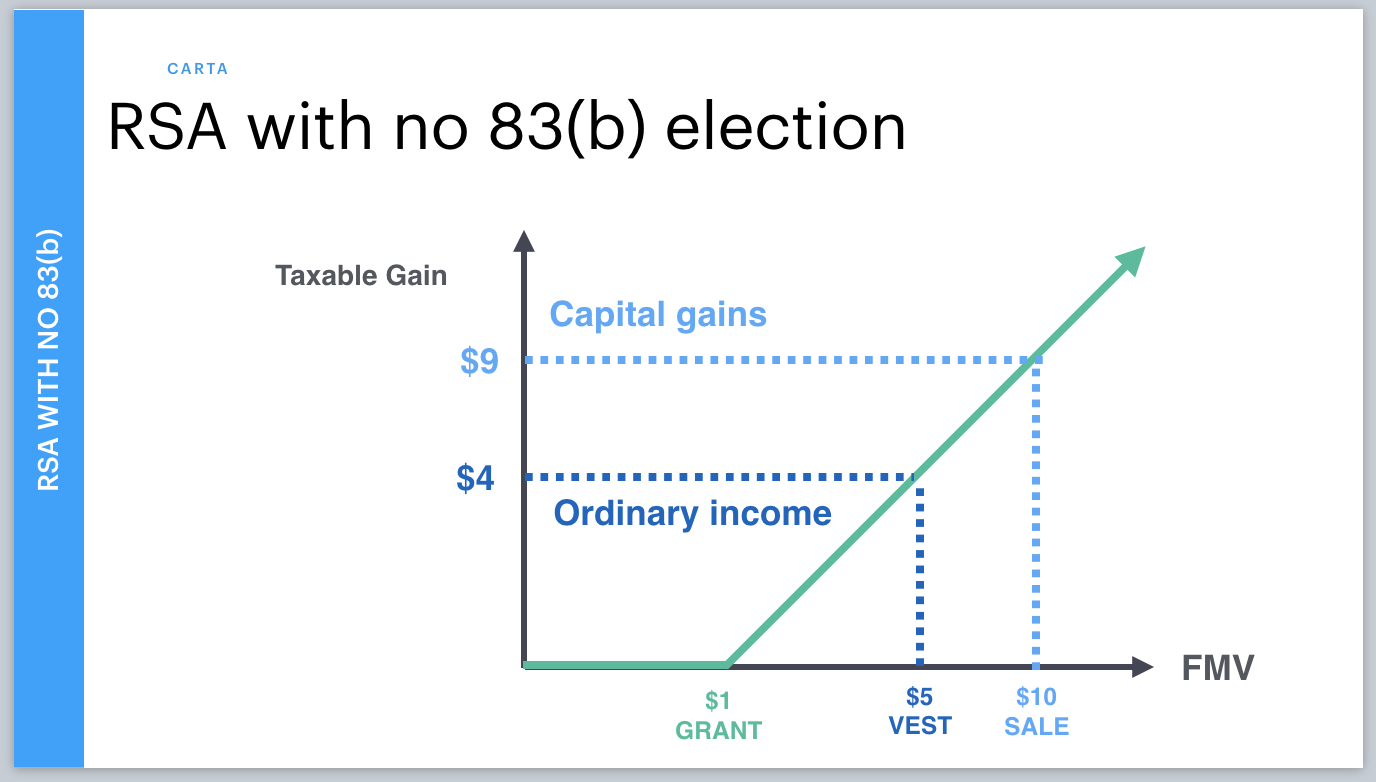

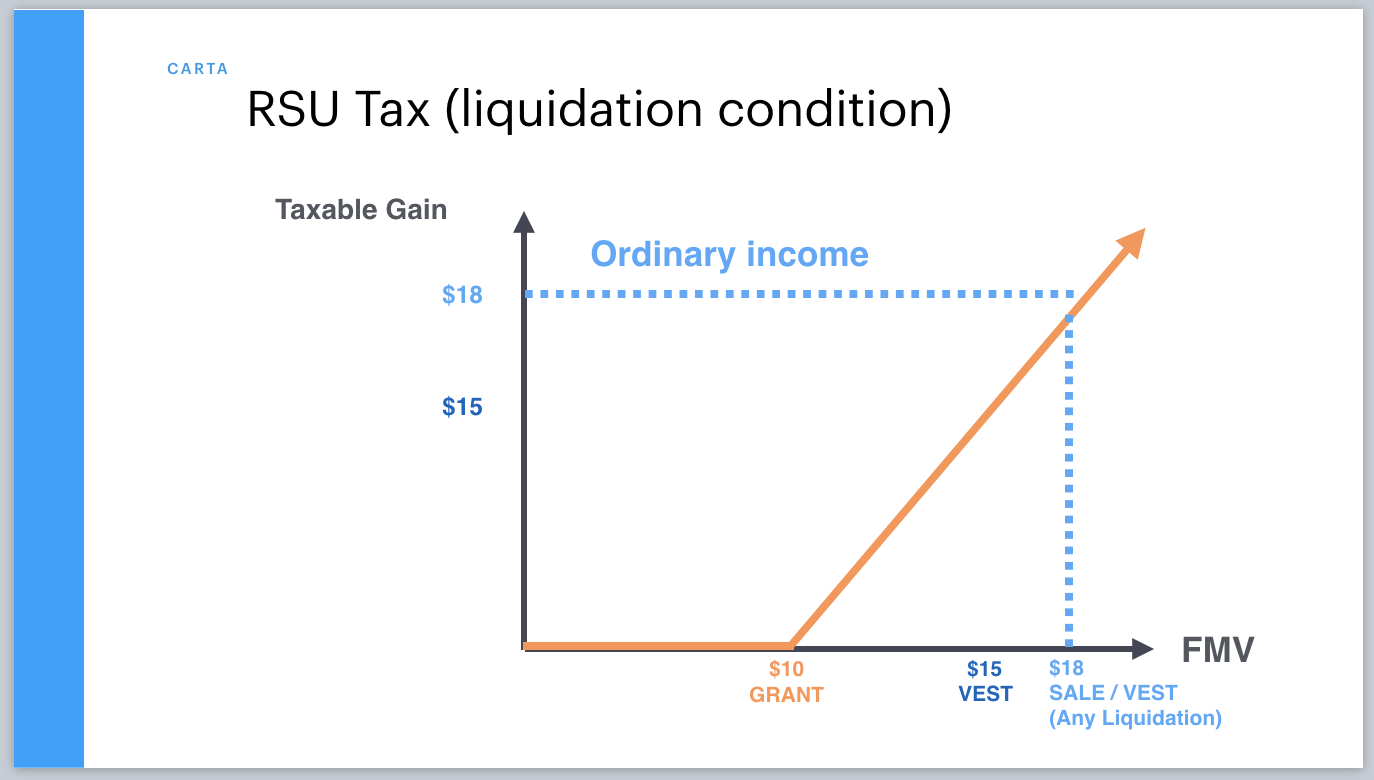

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Restricted Stock Units How Rsus Affect Your Clients Taxes Tax Pro Center Intuit

Restricted Stock Units Jane Financial

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta