unemployment benefits tax refund status

Division of Unemployment Insurance provides services and benefits to. Some refunds that are requested as Direct Deposit may be converted to paper check and mailed to the taxpayers address as a method of verifying that the refund is legitimate.

Your Unemployment Tax Refund Is Coming In May Irs Says Here S How To Get Yours Nj Com

The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed their.

. Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. If you spend more than a certain number of days in some states youre considered a resident. Unemployment Refund Tracker Unemployment Insurance TaxUni.

Assigned daily range of Social Security numbers. Effective July 27th 2021 you will no longer be able to file a new PUA claim through this portal. The IRS will determine the correct taxable amount of unemployment compensation and tax.

Already filed a tax return and did not claim the unemployment exclusion. Notice for Pandemic Unemployment Insurance Claimants. If you are receiving benefits you may have federal income taxes withheld from your.

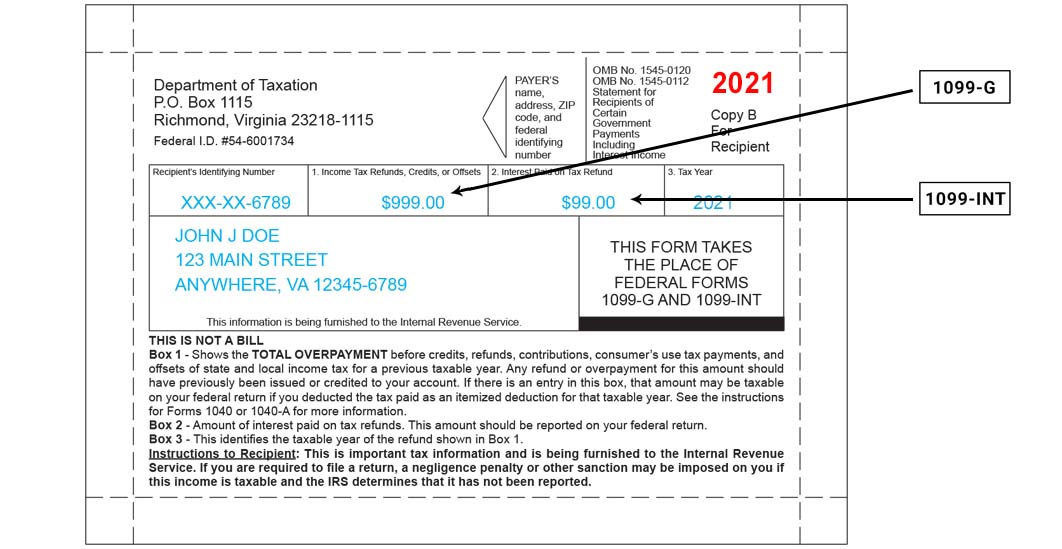

Viewing your IRS account. On Form 1099-G. Using the IRS Wheres My Refund tool.

You must report all unemployment benefits you receive to the IRS on your federal tax return. Need to certify for benefits. In Box 1 you will see the total amount of unemployment benefits you received.

Find information on Reporting Unemployment Benefits to the IRS this includes information. If youre anticipating an unemployment tax refund your best bet is to track the status of it and see. COVID Tax Tip 2021-87 June 17 2021 The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable.

The rules arent consistent from state to state so if you have any concerns check. Feb 17 2022 The IRS considers unemployment compensation to be taxable incomewhich you must report on your federal tax return. In Box 4 you will see the amount of federal income tax that was withheld.

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Tax Issues With Unemployment Benefits Get More Complicated Wgrz Com

Tax Refund Whiplash Pandemic Perks Give Some A Windfall Others A Bill Politico

Where S My Refund Tax Refund Tracking Guide From Turbotax

1099 G 1099 Ints Now Available Virginia Tax

If You Got Unemployment Benefits In 2020 Here S How Much Could Be Tax Exempt Abc News

Did You Get Michigan Unemployment Benefits In 2021 Don T File Your Taxes Yet Mlive Com

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Irs Tax Refunds To Start In May For 10 200 Unemployment Tax Break Brinker Simpson

Collecting Unemployment Could Impact Your Tax Refund

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

Unemployment 10 200 Tax Credit Irs Begins Refund In May If You Filed

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Did You Receive Unemployment Benefits In 2020 The Irs Might Surprise You With A Refund In November

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

Unemployment Compensation Exclusion Worksheet Schedule 1 Line 8 Page 2

2 8 Million People Are Getting Irs Refunds This Week 10 Million More May Get Money Too Wbff